In case you've missed it this spring, the Republican dominated Florida legislature, with the approval of Republican Gov. Ron Desantis, recently passed a measure that's been dubbed the "Don't Say Gay" Bill, one that proscribes what public school teachers can and cannot teach regarding sexual orientation and identification, among other provisions.

Ron Desantis with his mentor and potential future rival, former President Donald Trump, circa 2020

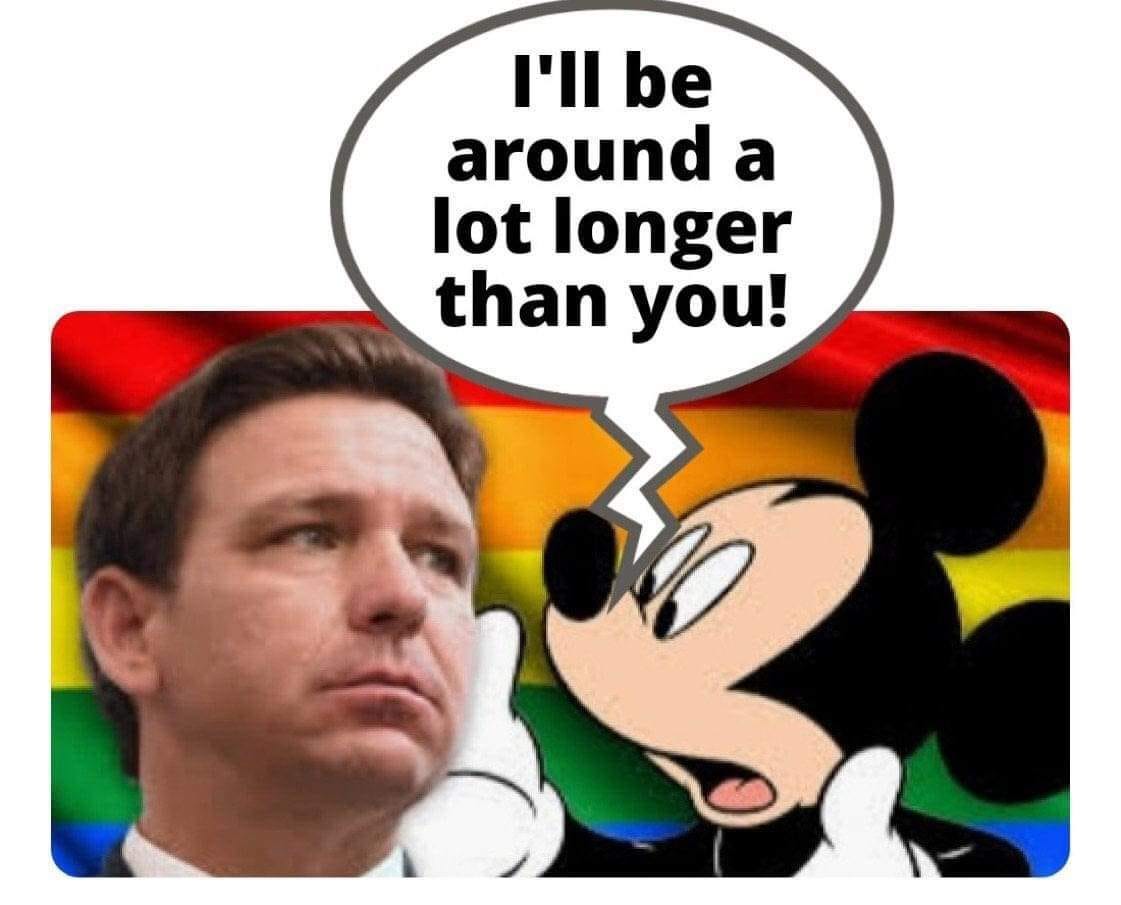

Walt Disney World, one of Florida's best known and most powerful companies, expressed displeasure with "Don't Say Gay" and by so doing, ignited a war of words with Desantis and his sycophantic followers in the legislature. This week, like a group of spoiled brats, Desantis and his cronies stripped Disney World of its Reedy Creek Improvement District status, one that it has held since 1967 (and allows it government autonomy and special tax status).

While Desantis and his crew have taken bows and congratulated themselves for "owning the liberals" by showing "who's boss" from their feeble minded (and mean-spirited) perspectives, the truth is that they may have cut off their collective noses to spite their faces—and the backlash could be severe once property taxes get raised along the population heavy I-4 corridor that runs from Daytona, through Orlando, and westward to Tampa.

Earlier today, I read a sobering analysis of the Desantis-Disney stakes that was written on the Facebook page of Nick Papantonis, a Central Florida journalist:

"There’s a lot of misinformation and confusion about what the end of Disney’s Reedy Creek district means for the company and for taxpayers.

Here’s what I know, after talking to lobbyists, lawyers and tax officials:

For those of you who haven’t heard, Reedy Creek is the special tax district of Walt Disney World. It’s essentially its own city. Disney pays taxes to Reedy Creek, which operates a fire department, planning department, sewer treatment plant and public works department. Disney controls Reedy Creek, which means if they want to build a new hotel or highway, they just have to ask themselves for permission.

The biggest loss for Disney is the end of that control. It’s a lot easier to ask yourself for permission than to go to the county. While they already follow all laws and building codes and they’ll still get everything they want, it’s going to slow the process down. Potholes might develop on roads that they no longer pave themselves. They can’t just call a meeting or alter their comprehensive plan on a random Friday. They also can’t quickly finance new public projects like a fire station.

The bigger issue for everyone else is the tax revenue. Disney already pays the same local property taxes as every other landowner. Reedy Creek added its own tax on top of that to pay for its projects. That tax – $163 million per year – is illegal outside of the district. When Reedy Creek goes away, that tax goes away, and Orange and Osceola Counties can’t do anything to get it back.

However, the counties will now be responsible for all of the services Reedy Creek provides and all of the debt it has accumulated. They can’t raise sales taxes or impact fees. So, the counties will have to raise property taxes to make up the difference. They must tax every property equally – not just Disney – and therefore it’s expected that property taxes in Orange County will rise as much as 25% next June. Osceola, much smaller and less wealthy, is still working on its figures.

Lawyers largely agree that the state followed all the laws while doing this. They agree Disney may sue, but probably doesn’t have much ground to stand on. Some believe a vote of residents or delegates from the district is required to make this legal. That doesn’t appear to be the case here because a vote was never held to implement the district 55 years ago.

Essentially, Disney will lose some control of its property, and get a $163 million per year tax break and ~$1 billion of debt passed onto taxpayers. Some things will be negotiated – Disney still controls Bay Lake and Lake Buena Vista, two actual towns within RCID. Lawmakers might backtrack from this plan during the next session now that they’re realizing what they’ve done. However, aside from maybe taking away the company’s ability to build a nuclear plant, we have yet to hear how this benefits Florida and especially the local residents in any way.

The residents, by the way, had no say in this vote, no say in their property taxes going through the roof, and no desire to have their communities staring at financial ruin thanks to 72 hours of orchestrated revenge."

You see, arrogance often blinds the ambitious, and hubris often destroys those who fail to comprehend that with the right financial backing, any politician can be defeated! I find it humorous, in a gallows humor sort of way, that the same “small government” and “tax lowering” Republicans have taken a course of action that expands state level meddling into local affairs—while raising potentially billions of dollars in taxes on millions of cash strapped voters!!! Lest we forget that Ron Desantis BARELY defeated his Democratic challenger Andrew Gillum in 2018, but this dilettante governs like he won by millions of votes and received a rousing conservative mandate!

To conclude, the 2022 Florida gubernatorial election could prove to be a VERY interesting battle once campaign dollars from Disney and other progressive leaning corporations/foundations kick in to humble Desantis, a man who is so self-assured that he will be the Republican presidential nominee in 2024 that he has foolishly poked the biggest financial bear (or giant mouse) in Florida—The Disney Company!

Thank you for subscribing to the Hobbservation Point—have a wonderful weekend!

Interesting dynamics! We’ll see how it all unfolds.

Can’t wait to see it smack him in his arrogant face.